Customer Acquisition Cost Calculator: Your Complete Guide

Understanding Customer Acquisition Cost (And Why It Matters)

Customer Acquisition Cost (CAC) is a vital metric for any business. It represents the total cost of gaining a new customer. This includes all the sales and marketing expenses involved in attracting and converting potential customers. Knowing your CAC is essential for evaluating your marketing strategies and ensuring sustainable growth.

Why CAC Matters

CAC has a direct impact on your profitability. If your CAC is higher than the revenue generated by a customer, your business loses money with each new acquisition. Tracking CAC isn't just about knowing the number; it's about understanding its relationship to your overall business health. A well-managed CAC also helps attract investors. It demonstrates a clear understanding of market dynamics and a strategic approach to customer acquisition.

A rising CAC can signal underlying problems, like inefficient marketing campaigns or a poorly defined target audience. A low CAC isn’t always good news, either. It might indicate underinvestment in sales and marketing, potentially missing growth opportunities. The key is finding a balance: acquiring customers efficiently without sacrificing potential growth.

Customer acquisition costs have increased significantly in recent years. In the last five years, they've jumped by 60%, reaching an average of $29 per new user in some sectors. Contributing factors include changes in privacy regulations (like GDPR and CCPA) and Apple's iOS 14.5 update, which limits tracking. For more detailed information, check out this resource: Learn more about rising CAC.

Breaking Down CAC Components

Many businesses overlook important expenses when calculating CAC. An accurate calculation must include all relevant costs. This goes beyond advertising spend to include other key areas:

- Sales and Marketing Salaries: The cost of your team's time spent on acquiring customers.

- Software and Tools: Subscriptions to CRM platforms, marketing automation software, and other tools.

- Content Creation: Costs related to creating marketing materials, blog posts, and other content.

- Overhead: Indirect costs such as office space, utilities, and administrative expenses.

Utilizing CAC in Decision-Making

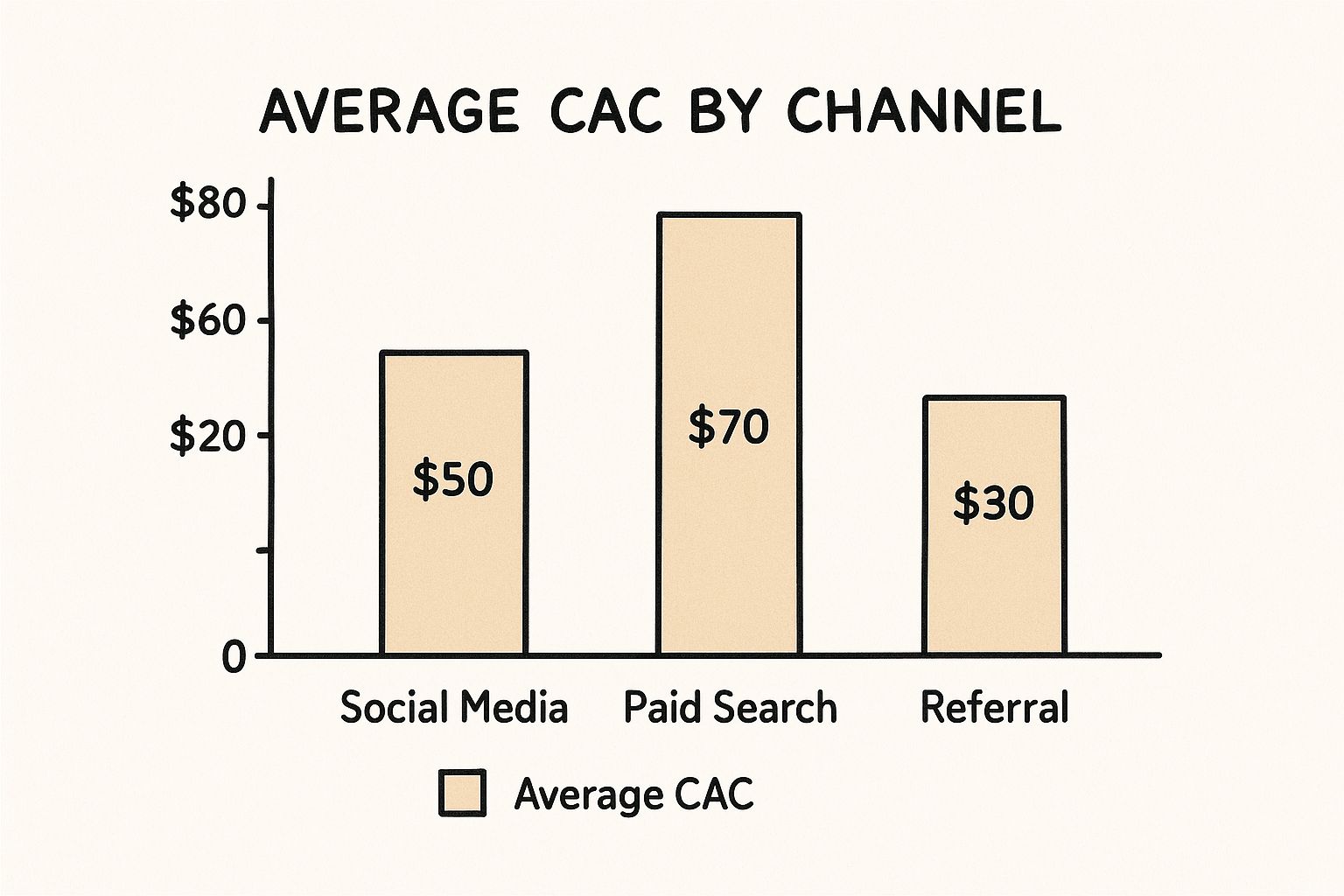

CAC is more than a metric; it's a tool for strategic decisions. By segmenting your CAC by channel, you can pinpoint the most cost-effective marketing efforts. For example, if social media advertising has a lower CAC than paid search, you might shift your budget accordingly. This data-driven approach helps optimize your marketing and achieve sustainable growth.

Comparing CAC to Customer Lifetime Value (CLTV) provides valuable insights. CLTV is the total revenue expected from a customer throughout their relationship with your business. A healthy CLTV:CAC ratio (ideally 3:1 or higher) indicates that your customer acquisition strategy is generating long-term value. This metric is critical for assessing the sustainability and profitability of your business model.

Industry Benchmarks: Where Your CAC Really Stands

Understanding your Customer Acquisition Cost (CAC) is essential. But knowing how your CAC stacks up against your competitors is just as important. Benchmarking helps you see how your business is performing and where you can improve. This is key for setting achievable goals and creating a sustainable growth plan. It’s important to remember that not all CACs are the same; a business-to-business (B2B) Software as a Service (SaaS) company will have different acquisition challenges than an e-commerce business.

Decoding Industry Differences

Several factors contribute to these industry variations. The length of the sales cycle plays a major role. A longer sales cycle, typical in B2B SaaS or Fintech, usually means a higher CAC. This is because more sales and marketing work is needed to nurture leads over a longer time. Product complexity also matters. Highly technical products or services often require more educational marketing and specialized sales teams, increasing acquisition costs.

The marketing strategies a business chooses also have a big impact on CAC. Companies that rely on pricey channels like paid advertising tend to have higher CACs than those focusing on organic growth.

To illustrate these differences, let's look at some industry averages. B2B SaaS companies have an average CAC of around $239. However, Fintech companies face a much higher average of $1,450. Other industries like Insurance ($1,280) and Medtech ($921) also have high CACs. For a deeper dive into these numbers, you can explore more detailed statistics here. This highlights why considering industry benchmarks is essential when evaluating your own CAC.

To further clarify these industry differences, let's look at a table summarizing average CAC, typical sales cycles, and primary acquisition channels:

To help visualize these industry differences, the following table provides a quick comparison across several key sectors:

Customer Acquisition Cost by Industry Comparison

| Industry | Average CAC | Typical Sales Cycle | Primary Acquisition Channels |

|---|---|---|---|

| B2B SaaS | $239 | Long (6-18 months) | Content marketing, email marketing, social media |

| Fintech | $1,450 | Long (6-12 months) | Paid advertising, partnerships, events |

| Insurance | $1,280 | Medium (3-6 months) | Affiliate marketing, direct mail, television |

| Medtech | $921 | Long (12-24 months) | Industry conferences, publications, webinars |

This table summarizes key differences in CAC, sales cycles, and acquisition channels across different industries. Notice the longer sales cycles and higher reliance on expensive channels like paid advertising and events in industries with higher CACs.

The infographic above shows the average CAC across different acquisition channels: social media, paid search, and referrals. The data shows that referral programs tend to have the lowest CAC, followed by social media marketing. Paid search, while effective, usually has a higher acquisition cost. These channel-specific insights can help you create a smarter marketing strategy and better allocate your budget.

Setting Realistic CAC Targets

Understanding industry benchmarks isn't just about comparing yourself to others. It's about setting achievable goals. By looking at the CAC of successful companies in your industry, you can create realistic expectations for your own business. This helps you use resources effectively and avoid overspending on acquisition.

Benchmarking also helps you pinpoint the most efficient acquisition channels for your industry. This knowledge helps you optimize your marketing mix and achieve sustainable growth without breaking your budget. This targeted approach is much more effective than simply aiming for a low CAC without considering your specific industry.

Leveraging Benchmarks for Growth

Analyzing industry averages can also offer valuable insights into your competitors' strategies. This information can help you shape your own customer acquisition approach and find opportunities to differentiate your business. Understanding industry trends in CAC can also help you anticipate future challenges and adapt your strategies proactively.

By combining these benchmarks with insights from your own customer acquisition cost calculator, you can build a solid, data-driven growth strategy. This strategy will help you acquire customers efficiently and build a profitable business, ensuring your CAC drives growth, not hinders it.

Building Your Customer Acquisition Cost Calculator

Simply dividing your marketing spend by the number of new customers won't give you the full story. A truly effective Customer Acquisition Cost (CAC) calculator needs to be more detailed. This means factoring in every relevant cost, even those often missed. This section will show you how to build a solid CAC calculator that provides real insights to help your business grow.

Identifying Hidden Costs

Many businesses only consider obvious marketing costs like advertising. However, several hidden costs have a big impact on your true CAC.

For example, think about the salaries of your sales and marketing teams. The time they dedicate to acquiring customers contributes directly to your CAC. The cost of software tools, such as a CRM platform like Salesforce, and marketing automation software, should also be factored in. Content creation, whether done in-house or by freelancers, adds to the overall cost as well.

Don't forget overhead costs. These indirect expenses, like rent, utilities, and administrative support, affect your total CAC. Overlooking these expenses can significantly skew your understanding of your profitability. A comprehensive approach ensures you see the complete cost of gaining each new customer.

Structuring Your Calculator

A well-structured calculator should offer analysis across different time periods and channels. You should be able to calculate your CAC monthly, quarterly, or annually. This helps you spot trends and seasonal changes in your acquisition costs.

Breaking down costs by acquisition channel is also important. You'll want to know the CAC for your social media campaigns separately from your paid search campaigns, for example.

A simple table can help organize your data:

| Channel | Period (Month/Quarter/Year) | Marketing Spend | Sales Spend | Overhead Allocation | New Customers | CAC |

|---|---|---|---|---|---|---|

| Social Media | January 2024 | $500 | $200 | $50 | 10 | $75 |

| Paid Search | January 2024 | $1000 | $300 | $75 | 15 | $91.67 |

This table shows how separating your CAC calculations by channel and time provides a more detailed view of your marketing performance.

Building in Flexibility

Your acquisition strategies will change as your business grows. Your CAC calculator needs to adapt. This might involve adding new channels, adjusting overhead allocations, or tracking additional metrics.

For example, adding fields for individual campaign costs or sales commissions can improve accuracy. By proactively including variables, your calculator remains a powerful, up-to-date tool. This flexibility ensures your decisions are based on accurate, relevant data.

Essential Metrics That Transform CAC Into Strategy

Raw Customer Acquisition Cost (CAC), the number you get from your customer acquisition cost calculator, is just a starting point. To gain a real strategic advantage, you need to understand the bigger picture. This means looking at other key metrics that, when combined with your CAC, give you a complete view of how well your acquisition efforts are performing.

The Power of LTV:CAC

One of the most important metrics is Customer Lifetime Value (CLTV). This represents the total revenue you expect from a single customer throughout their entire relationship with your business. The relationship between CLTV and CAC is expressed as the LTV:CAC ratio. This ratio is a powerful indicator of whether your customer acquisition efforts will be profitable in the long run.

A healthy LTV:CAC ratio is generally considered to be 3:1 or higher. This simply means that for every dollar you spend acquiring a customer, you expect to generate at least three dollars in revenue over their lifetime. To explore calculating potential savings, you might find an AI Savings Calculator useful.

A lower ratio may suggest your acquisition costs are too high or that you aren't retaining customers long enough. On the other hand, a much higher ratio could mean you're not investing enough in acquiring new customers, potentially missing out on growth opportunities. Finding the right balance is key for sustainable growth.

Payback Period and Cash Flow Planning

Another important metric is the CAC payback period. This measures how long it takes to earn back your initial CAC investment through the revenue generated by a customer. Knowing your payback period is vital for planning your cash flow effectively.

A shorter payback period, for example, improves your cash flow, letting you reinvest profits faster. This is especially important for businesses with limited resources.

Retention’s Ripple Effect

Customer retention has a surprisingly significant impact on your CAC. High retention rates lower your overall CAC over time because you’re spending less to acquire new customers to replace those who leave.

For instance, if you double your customer retention rate, you effectively halve the number of new customers you need to acquire to maintain the same revenue. This directly reduces your overall CAC and boosts your profitability. You might be interested in learning more about how to master analytics for chatbots.

Cohort Analysis for Accurate Forecasting

Finally, cohort analysis, which groups customers acquired in the same timeframe, offers valuable insights into how your CAC and other metrics evolve over time. This helps identify trends, optimize campaigns for specific customer segments, and improve the accuracy of forecasts for future acquisition costs and revenue.

By analyzing different cohorts, you could discover, for example, that customers acquired through a specific channel have both a lower CAC and a higher LTV.

Key Metrics Dashboard

To help you understand the key metrics to track, we've compiled the following table:

Key Metrics Dashboard for CAC Analysis Essential metrics to monitor alongside CAC for comprehensive acquisition performance analysis

| Metric | Definition | Calculation | Healthy Benchmark |

|---|---|---|---|

| LTV:CAC Ratio | Compares customer lifetime value to acquisition cost | LTV / CAC | 3:1 or higher |

| CAC Payback Period | Time to recoup CAC investment | Total CAC / Average Revenue per Customer per Month | Less than 12 months |

| Customer Retention Rate | Percentage of customers who continue their subscription | (Customers at End of Period - New Customers Acquired During Period) / Customers at Start of Period | As high as possible, depending on industry |

By regularly monitoring and analyzing these key metrics alongside your CAC, you transform a simple calculation into a powerful strategic tool for sustainable growth and long-term profitability.

Turning CAC Data Into Acquisition Wins

Calculating your Customer Acquisition Cost (CAC) is just the first step. The real power comes from using this data to refine your acquisition strategy and improve profits. This section explains how to turn CAC insights into practical actions for lowering acquisition costs while keeping, or even boosting, customer quality.

Optimizing Your Acquisition Channels

Different acquisition channels perform differently. Some will naturally be more efficient for your business. Analyzing your CAC by channel reveals which sources offer the best return on investment. This lets you focus on high-performing channels and reduce spending on those that underperform.

For example, if your CAC for social media marketing is substantially lower than your CAC for paid search, you could shift budget from paid search to social media. This isn’t simply about cutting costs; it's about optimizing your overall marketing approach.

By pinpointing your best channels, you can invest more in what works and get the most out of your marketing budget. For deeper insights into maximizing marketing returns, consider strategies to improve your influencer marketing ROI. This data-driven approach helps you scale your business effectively and sustainably.

Improving Conversion Rates

Even small conversion rate improvements can significantly impact your CAC. Imagine your sales funnel as a leaky bucket. Fixing the leaks at each stage retains more potential customers and maximizes your marketing investment.

This might involve improving landing pages, simplifying the checkout process, or tailoring email marketing campaigns. For example, A/B testing different calls to action on your website could substantially increase conversions. This directly lowers your CAC because you acquire more customers from the same marketing efforts.

Explore our guide on how to master website sales improvements for more detailed strategies. Continuously testing and refining your methods helps improve conversion rates and reduce wasted ad spend.

Enhancing Targeting and Shortening Sales Cycles

Reaching the right prospects with the right message is crucial for minimizing CAC. Better targeting means focusing on high-value prospects most likely to become paying customers. This might involve refining your buyer personas, using more specific targeting in your ad campaigns, or implementing lead scoring to prioritize qualified leads.

Shortening your sales cycle also reduces the time and resources needed to acquire each new customer. This could mean streamlining your sales process, automating follow-up communication, or using better sales tools for your team.

Imagine shortening your sales cycle from six months to three months. This effectively halves the time your sales team spends on each prospect, significantly reducing your CAC. Likewise, targeting high-value prospects increases your chances of acquiring customers who generate more revenue over their lifetime, enhancing your LTV:CAC ratio. By combining these strategies, you can significantly improve the efficiency and results of your customer acquisition efforts.

Advanced CAC Analysis: Segmentation That Drives Growth

Calculating your Customer Acquisition Cost (CAC) is an important first step. But truly data-driven companies dig deeper. They segment their CAC to pinpoint strengths and weaknesses. This advanced analysis reveals hidden opportunities to optimize acquisition strategies and fuel growth.

Segmenting Your CAC: Unveiling Hidden Insights

Segmenting your CAC means breaking down the overall cost by different factors. This provides a more granular view than a single, overall CAC number. Consider segmenting by these key dimensions:

- Customer Type: Do different customer segments (e.g., enterprise vs. small business) have different acquisition costs? Attracting enterprise clients might require more expensive marketing, resulting in a higher CAC.

- Acquisition Channel: Channels like social media, paid search, and referrals all have varying CACs. Understanding these differences is key for optimizing your marketing mix.

- Geography: If you operate in multiple regions, segmenting by geography can be insightful. CAC can change due to varying market dynamics and advertising costs in different locations.

- Product/Service: Do certain products or services have a higher CAC? This data can inform pricing strategies and product development decisions.

For example, imagine discovering your CAC for enterprise clients acquired through referrals is significantly lower than through paid advertising. This might lead you to invest more in enterprise-focused referral programs.

Forecasting Future CAC: Planning for Success

Understanding past and present CAC is important. But anticipating future CAC is equally crucial for planning. Forecasting lets you proactively adjust budgets and strategies.

Several factors can influence future CAC:

- Market Trends: Changes in advertising costs, competition, and consumer behavior all impact CAC. Stay informed about industry trends to anticipate shifts.

- Seasonal Patterns: Many businesses have seasonal CAC variations. Understanding these patterns allows you to allocate resources strategically. For example, if CAC typically rises during the holidays due to increased competition, you can plan by increasing your budget or adjusting bidding strategies.

- Business Growth: As your business scales, your CAC might change. Factor in projected growth rates when forecasting acquisition costs.

Building scenario models is a valuable forecasting technique. Create different "what-if" scenarios based on potential market conditions or business decisions. For instance, model the impact of a 10% increase in advertising costs or a new product launch on your CAC. This helps you prepare and make informed decisions.

Scaling Your Measurement Approach

As your business grows, simple spreadsheets may not suffice for managing your CAC calculations. Consider investing in more robust tracking tools. These tools can automate data collection, provide more granular segmentation, and integrate with other marketing and sales platforms. Evaluating different tools is essential. You might be interested in: How to master customer satisfaction measurement methods. By leveraging advanced tools and techniques, you can gain a deeper understanding of your CAC and unlock valuable growth opportunities. This ensures you're not just measuring CAC, but actively using it to drive strategic decisions and optimize your acquisition efforts.

Key Takeaways

Mastering Customer Acquisition Cost (CAC) is essential for sustainable business growth. This section outlines key strategies and insights to help you effectively manage and optimize your CAC.

Understanding the Core Concepts of CAC

CAC represents the total cost of acquiring a new customer. Calculating CAC comprehensively means factoring in all marketing and sales expenses. This includes often-overlooked costs like overhead and salaries.

Tracking CAC is crucial for evaluating marketing campaign effectiveness and overall profitability, and it's a key metric for attracting investors. A rising CAC could signal underlying issues, like inefficient campaigns or a saturated market.

Key components of an accurate CAC calculation include sales and marketing salaries, software and tool subscriptions like those offered by HubSpot, content creation costs, and allocated overhead expenses.

Benchmarking and Target Setting

CAC varies significantly across industries due to differences in sales cycles, product complexity, and marketing strategies. For example, B2B SaaS companies typically have lower CACs than Fintech companies.

Benchmarking your CAC against competitors helps set achievable goals. This allows for effective resource allocation and prevents overspending on acquisition efforts. Understanding industry averages provides a valuable context for interpreting your own CAC data.

Utilizing Metrics to Drive Strategy

The relationship between Customer Lifetime Value (CLTV) and CAC is critical. A healthy LTV:CAC ratio (3:1 or higher) indicates a profitable acquisition strategy, meaning your customers generate more revenue over their lifetime than it costs to acquire them.

The CAC payback period reveals how long it takes to recoup your initial investment in acquiring a customer. A shorter payback period enhances cash flow and creates more reinvestment opportunities.

High customer retention rates naturally lower your overall CAC. By retaining existing customers, you reduce the need to constantly acquire new ones, saving on marketing and sales expenses.

Optimization and Growth Strategies

Analyzing CAC by channel identifies cost-effective acquisition sources and allows for strategic budget allocation. Shifting resources from underperforming channels to high-performing ones maximizes ROI.

Even small improvements in conversion rates dramatically impact CAC. Optimizing landing pages, streamlining checkout processes, and A/B testing different calls to action can all contribute to enhanced conversions.

Enhancing targeting by focusing on high-value prospects and shortening the sales cycle by streamlining sales processes significantly reduces CAC. This focuses resources on customers most likely to convert and reduces the time and cost associated with each acquisition.

Advanced Analysis and Segmentation

Segmenting CAC by customer type, acquisition channel, geography, and product/service reveals hidden insights and optimization opportunities. This granular approach allows you to tailor your strategies for different customer segments.

Forecasting future CAC, considering market trends, seasonal patterns, and business growth projections, allows for proactive budget adjustments and strategic planning.

As your business grows, moving beyond spreadsheets to more sophisticated tracking tools, like those offered by Google Analytics, enables automated data collection and more granular segmentation.

By implementing these key takeaways and continuously analyzing your CAC, you can transform this simple metric into a powerful strategic asset, optimizing your acquisition efforts and driving sustainable growth.

Table of Contents

- Why CAC Matters

- Breaking Down CAC Components

- Utilizing CAC in Decision-Making

- Industry Benchmarks: Where Your CAC Really Stands

- Building Your Customer Acquisition Cost Calculator

- Essential Metrics That Transform CAC Into Strategy

- Turning CAC Data Into Acquisition Wins

- Advanced CAC Analysis: Segmentation That Drives Growth

- Key Takeaways